Why Was Bitcoin Created?

Introduction

In the last article, I described how I define Bitcoin: as both a new form of money and a new kind of monetary system. But where did it come from? Who created it? And what problem does it solve?

To answer that, we need to look at what was happening in the world when Bitcoin appeared.

The Financial Crisis

Do you remember what happened in 2008? The global financial crisis. Major financial institutions collapsed or had to be rescued, including Lehman Brothers, Bear Stearns, and Washington Mutual, and millions of people lost their jobs, their savings, and their homes.

The causes of this crisis are complex. In 2009, the United States established the Financial Crisis Inquiry Commission to investigate what went wrong. Their official report summarizes it like this:

"While the vulnerabilities that created the potential for crisis were years in the making, it was the collapse of the housing bubble — fueled by low interest rates, easy and available credit, scant regulation, and toxic mortgages — that was the spark that ignited a string of events, which led to a full-blown crisis in the fall of 2008." – The Financial Crisis Inquiry Report, January 2011, p. xvi

There is much more to this story. But instead of going deeper into the causes, let me describe it from the perspective of ordinary people.

They watched on television and read in newspapers how banks had taken reckless risks, lost everything, and went bankrupt, nearly taking the entire financial system down with them. Yet almost no one went to prison. Instead, governments stepped in with taxpayer money and rescued most of those institutions. The people who lost the most, their jobs, their savings, their homes, were the same people whose taxes paid for the rescue.

What stayed with many people was not just the loss, but a realization: our financial system depends on trust. It depends on banks holding our money, on governments regulating them, and on central banks keeping the currency stable. The crisis showed what happens when that trust breaks down.

It was in the midst of this crisis that an idea emerged. An idea that replaces trust in financial institutions with trust in mathematics and technology. That idea is Bitcoin.

The Bitcoin Whitepaper

On October 31, 2008, someone under the pseudonym Satoshi Nakamoto posted a message titled "Bitcoin P2P e-cash paper" to a cryptography mailing list. It was the first time Bitcoin was publicly announced. The message began with:

"I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party." – Satoshi Nakamoto, Cryptography Mailing List, October 31, 2008

It included a link to what is now known as the Bitcoin Whitepaper.

The paper is only nine pages long, but it describes the mechanisms of Bitcoin in a very precise way. It focuses on the essentials and does not go into unnecessary detail. What made it different was not any single new technology, but the way Satoshi combined existing ideas, some dating back decades, into a system that, for the first time, actually worked without a central authority.

Despite being a self-published, non-peer-reviewed paper by an anonymous author, the whitepaper has been cited thousands of times on Google Scholar. The vast majority of academic papers never reach even a fraction of that.

Already in the first sentence of the introduction, Satoshi names the problem he wants to solve:

"Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments." – Bitcoin Whitepaper

The Creator

Who is Satoshi Nakamoto? Nobody knows for certain. Is it a man or a woman? One person or a group? Is this person still alive? Many theories exist, but the identity behind this pseudonym has been hidden so well that I doubt it will ever be revealed.

According to a forum post by Satoshi and research into the Bitcoin development history, he began working on Bitcoin in early 2007, as the financial crisis was slowly but visibly building. After launching Bitcoin in January 2009, Satoshi remained active in the community for about two years, writing forum posts, responding to questions, and improving the software. His last known communication recognized by the community was on April 23, 2011, ending with the words: "I've moved on to other things."

The Genesis Block

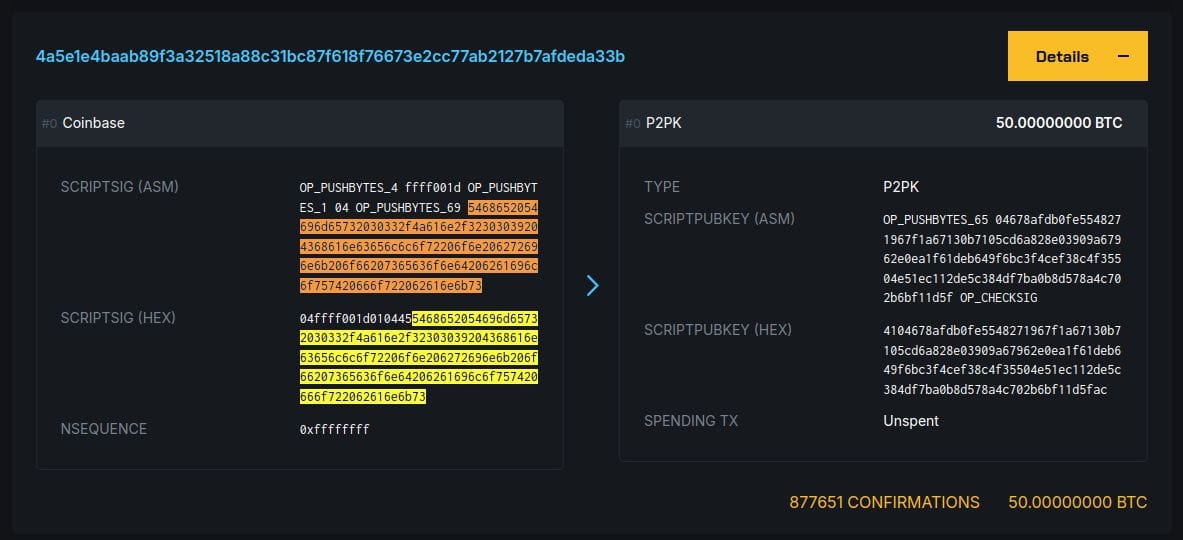

On January 3, 2009, Bitcoin went live. Satoshi created the first block, known as the "Genesis Block".

This first block contains a hidden message, embedded directly in its raw data:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" – Genesis block transaction

This is the headline from the front page of The Times newspaper on that very day. It was not placed there by accident. With this message, Satoshi permanently linked Bitcoin's beginning to the financial crisis.

If you want to verify this yourself, you can decode the raw hexadecimal data from the Genesis Block transaction.

So far, I have described when Bitcoin appeared, who created it, and why. But there is one question left: what technical problem does Bitcoin actually solve?

The Problem

Digital money has a fundamental problem that physical money does not have: digital data can be copied. If you hand someone a banknote, you no longer have it. But if you send someone a digital file, you still have the original. This makes digital money fundamentally different from physical money, and it creates a problem known as double spending.

Let me explain this with a simple example. Alice has 10 units of digital money. She wants to buy a picture from Bob and sends him 2 units. But what prevents Alice from sending those same 2 units to Carol as well? After all, the 2 units are just data, and data can be copied.

The obvious solution is to keep a record of all transactions: a shared list that tracks who owns what. But this raises a critical question: who keeps that list? If Alice keeps it, Bob has to trust Alice. If a bank keeps it, everyone has to trust the bank. No matter who maintains the list, someone has to be trusted. In the traditional financial system, that someone is a bank or a payment processor. They are the trusted third party.

Satoshi described this problem in a forum post shortly after Bitcoin launched:

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve." – Satoshi Nakamoto, P2P Foundation, February 11, 2009

This is the core problem that decades of research tried to solve. The idea of digital money is older than Bitcoin. As early as 1983, cryptographer David Chaum proposed a system for anonymous digital payments. In the 1990s, a community known as the Cypherpunks took up this vision, seeing cryptography as a tool to protect individual privacy and viewing digital money without central control as a goal. Several projects attempted to make this a reality, but none of them managed to solve the double spending problem without relying on a central authority.

It was not until Bitcoin that the double spending problem was solved without a trusted third party. Instead of giving one entity the authority to keep the list, Bitcoin lets everyone keep a copy. The network uses cryptography and a consensus mechanism called Proof-of-Work to ensure that all participants agree on which transactions are valid and that no one can spend the same money twice. I will explain how this works in detail in the upcoming articles.

Conclusion

Bitcoin emerged at a specific moment in history, when the global financial crisis showed how much our financial system depends on trust in central institutions. And it solved a problem that decades of research could not solve: how to transfer value digitally without trusting any institution. Satoshi Nakamoto took the motivation from the crisis and the technical ideas from decades of prior work and combined them into a single system that replaces institutional trust with mathematics.

In the next article, I will explain how this system actually works, starting with the cryptographic foundations that make Bitcoin secure.

If you have questions or feedback, feel free to reach out. And if you found this article helpful, consider sharing it with others who want to understand Bitcoin.